What does 1099g notice mean for unemployment ~ All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. For information about this statement contact the Department of Workforce Development at. Indeed recently has been hunted by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to see image and video information for inspiration, and according to the name of this article I will discuss about What Does 1099g Notice Mean For Unemployment Once finished they will click Save.

Source Image @ www.investopedia.com

Form 1099 G Certain Government Payments Definition

This will help save taxpayer dollars and allow you to do a small part in saving the environment. Keep in mind 1099-G form is every important to anyone who are receiving or received unemployment benefit in 2020 and later because. Your What does 1099g notice mean for unemployment photographs are ready in this website. What does 1099g notice mean for unemployment are a topic that has been searched for and liked by netizens now. You can Find and Download or bookmark the What does 1099g notice mean for unemployment files here

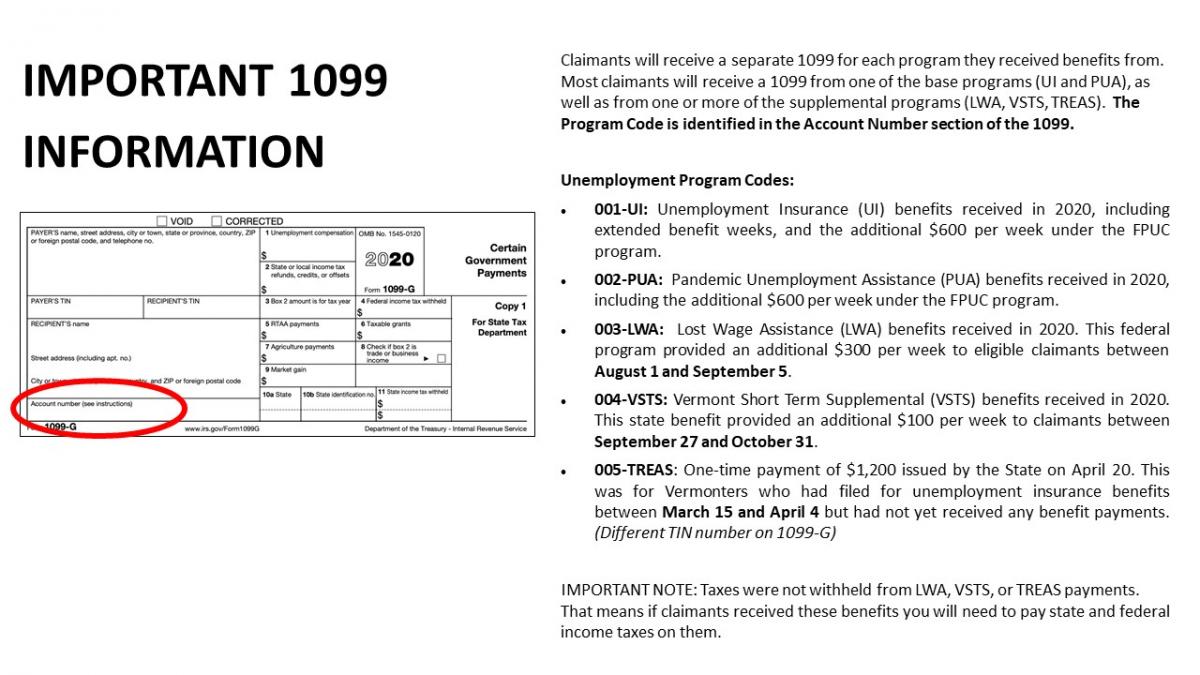

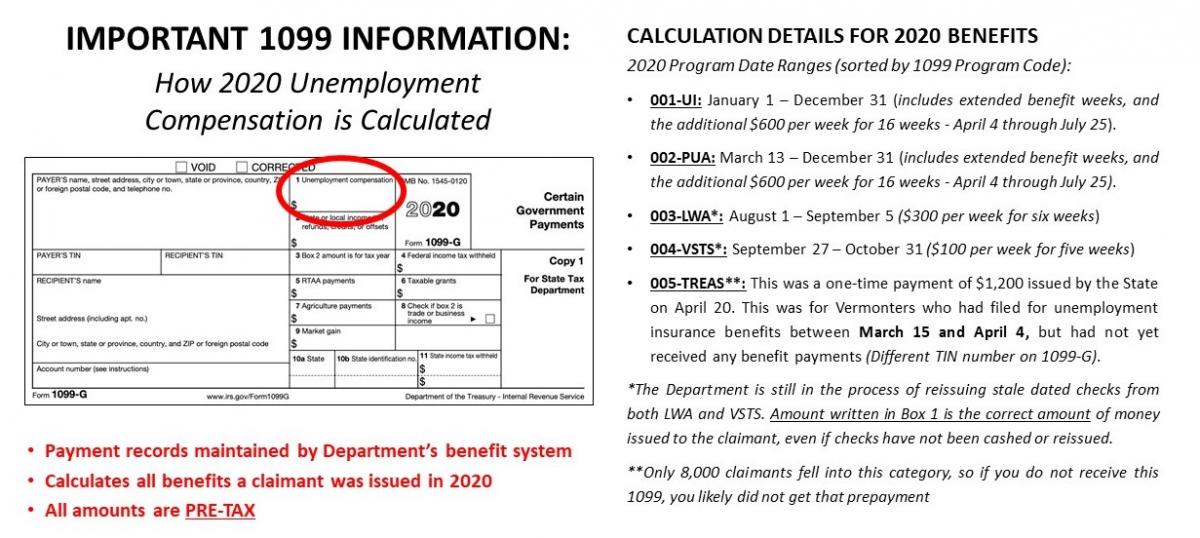

What does 1099g notice mean for unemployment - What is a 1099G form. This means they will also receive Form 1099-G which is subtitled Certain Government Payments along with their other tax-related forms. State unemployment laws contain general and state-specific information on unemployment overpayment unemployment compensation and benefits. If you do not receive a Form 1099G because you have moved since you last claimed benefits or if you need a duplicate Form 1099G from a previous year you may contact the UI.

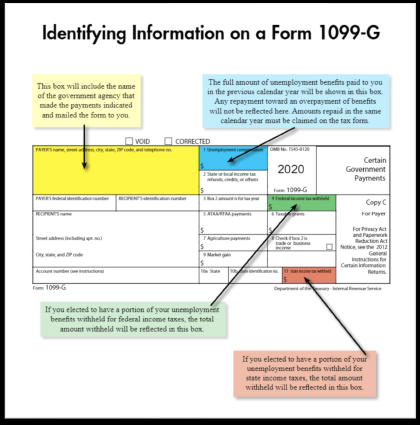

Unemployment benefit is taxable and you have to show it as your unearned-income in your tax return 2020. If you have questions about your 1099-G call 608 266-2999. If you have not already done so they can help you change your PIN number. Form 1099G is a record of the total taxable income the California Employment Development Department EDD issued you in a calendar year and is reported to the IRS.

The Business Action Center can assist you with obtaining your General Excise tax license Unemployment Insurance tax registration business and trade name registrations and federal employers identification number FEIN. Monday through Friday 8 am to 6 pm. Call Center at 1-866-783-5567 for assistance or send us a written request. After receiving a notice visit Benefit Overpayment Services to learn how to repay an existing overpayment.

If you are married filing jointly. Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot. Or you might need to go to your states unemployment website and use the password etc. Except as explained below this is your taxable amount.

Then click on Unemployment Services and ViewPrint your 1099G Contact the Department of Labor at 888-209-8124 and follow the automated instructions to have a 1099G mailed to you. Call the unemployment office at 1-877-644-6562 1-877-OHIO-JOB. What does monetarily eligible mean. Some states will mail out the 1099G.

Form 1099G - Issued by the Department of Workforce Development. Make sure you double-check your Form 1099-G even if you did claim and receive unemployment insurance benefits. In the second text box they will indicate what amount they believe should be on the 1099G. Remember that state laws vary.

When should i receive my 1099 g for unemployment. You can elect to be removed from the next years mailing by signing up for email notification. Tax form 1099G details the total unemployment benefits you receive in a. Contact your state unemployment office for a determination of your specific circumstances and clarification about how overpayment is handled in your state.

A record number of Americans April 2020 saw the highest number ever recorded received unemployment. Call during the hours of operation. What does it mean when you get a 1099-G. You received a Form 1099-G reporting in Box 1 unemployment insurance benefits that you never received or an amount greater than what you actually received during the year.

This is effective for the claim week ending. This form does not include unemployment compensation. The claimant will choose the years 1099G that they are wishing to dispute in the first drop down. It is important to repay this benefit overpayment as soon as possible to avoid collection and legal action.

If unemployment benefits appear in your bank account as being paid but you did not receive them you should take the following actions. Shows the total unemployment compensation paid to you this year. Unemployment compensation is taxable on your federal return. The amount showing in Box 1 might be overstated if your identity was stolen and someone submitted a.

The 1099-G is used to report the total taxable unemployment compensation issued to you for the year. A notification of claim is sent to the employer requesting verification of the dates of employment and the reason you separated. Thats largely due to the economic and other effects of the COVID-19 pandemic. The Internal Review Service IRS requires that Form PUA-1099G be provided to unemployment compensation recipients who were paid Pandemic Unemployment Assistance PUA benefits during the prior year.

Federal state or local governments file this form if they made payments of. You will receive a Form 1099G if you collected unemployment compensation UC from the EDD and must report it on your federal tax return as income. That you have been using to certify for weekly benefits to get your 1099G from the states site. They also file this form if they received payments on a Commodity Credit Corporation CCC loan.

If you received a 1099 G Form this year from a government agency you may need to report some of the information it contains on your tax return. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. Indiana Department of Workforce Development Benefit Administration Section. The most common uses of the 1099 G is to report unemployment compensation as well as any state or local income tax refunds you received that year.

How do I contact the Employer Field Claims EFC unit. If my employer does not file my claim should I file it myself. State laws vary regarding state income tax laws and unemployment. DES has begun mailing 1099-G tax forms to individuals who received Arizona unemployment benefits.

State or local income tax refunds credits or offsets. Unemployment form 1099g what to do about overpayment paid back - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. The Form 1099G issued by the Department of Workforce Development is a report of unemployment compensation issued to you. You will have to enter a 1099G that is issued by your state.

And after unemployment claimants must report at least two work search activities in the weekly payment request to be eligible. If you received unemployment benefits you were not eligible for known as an overpayment we will send you a notice. Combine the box 1 amounts from all Forms 1099-G and report the total as income on the unemployment compensation line of your tax return. This statement shows the total or gross amount of PUA benefits received and the amount of federal tax withheld if any.

In the first text box they will give the reason for wishing to dispute. Reemployment trade adjustment assistance RTAA payments. Unemployment compensation is treated as regular income and is taxable on a federal tax return.

Source Image @ dlt.ri.gov

Source Image @ www.wgal.com

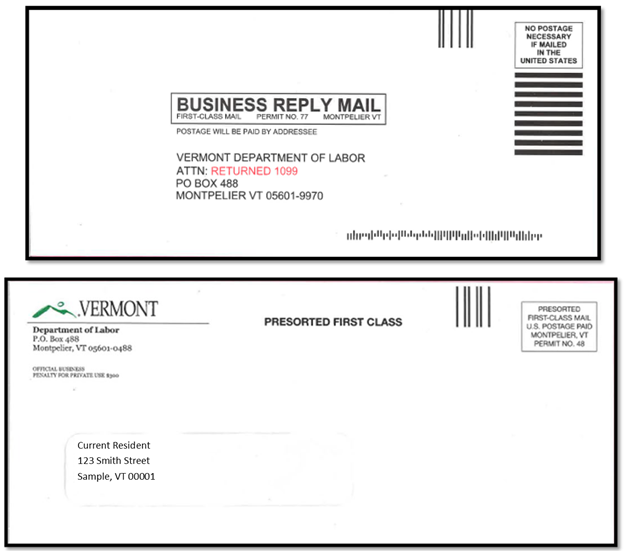

Source Image @ labor.vermont.gov

Source Image @ labor.vermont.gov

Source Image @ www.jacksonhewitt.com

Source Image @ labor.vermont.gov

Source Image @ support.thomas-and-company.com

Source Image @ labor.vermont.gov

Source Image @ www.investopedia.com

If you are searching for What Does 1099g Notice Mean For Unemployment you've come to the perfect location. We ve got 10 graphics about what does 1099g notice mean for unemployment adding images, photos, photographs, backgrounds, and more. In such webpage, we also provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

If the publishing of this internet site is beneficial to your suport by revealing article posts of this site to social media marketing accounts that you have such as Facebook, Instagram among others or can also bookmark this website page using the title Form 1099 G Certain Government Payments Definition Employ Ctrl + D for computer system devices with Home windows operating-system or Demand + D for computer devices with operating system from Apple. If you use a smartphone, you can also use the drawer menu of this browser you utilize. Be it a Windows, Macintosh, iOs or Android operating system, you'll still be in a position to download images using the download button.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

0 comments:

Post a Comment