What does irs notice cp504b mean ~ IRS Notice CP504B Business Notices. We havent received your payment for overdue taxes. Indeed lately has been hunted by users around us, perhaps one of you. People are now accustomed to using the internet in gadgets to view video and image data for inspiration, and according to the name of this post I will talk about about What Does Irs Notice Cp504b Mean Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue.

Source Image @ trp.tax

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

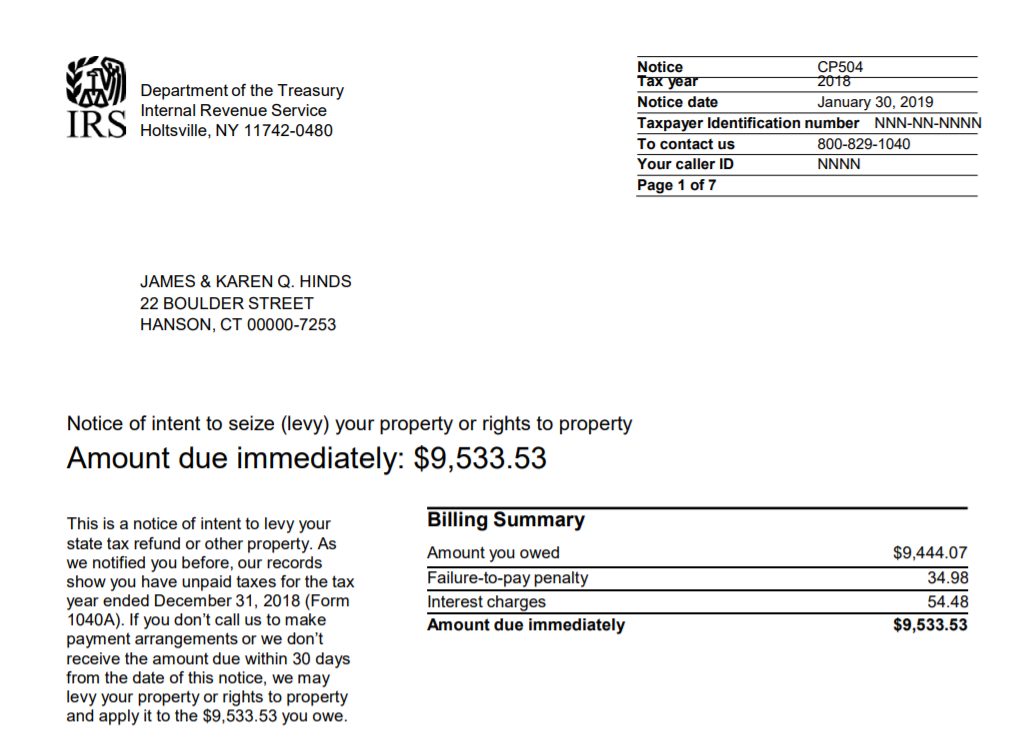

It is therefore important to have knowledge of what IRS notices mean and which of those notices give rise to a right to an Appeal of IRS. If you disagree with or if you cant full pay the CP504 Notice the IRS must be immediately contacted and informed of your position and intentions. Your What does irs notice cp504b mean photographs are available in this site. What does irs notice cp504b mean are a topic that is being searched for and liked by netizens now. You can Get or bookmark the What does irs notice cp504b mean files here

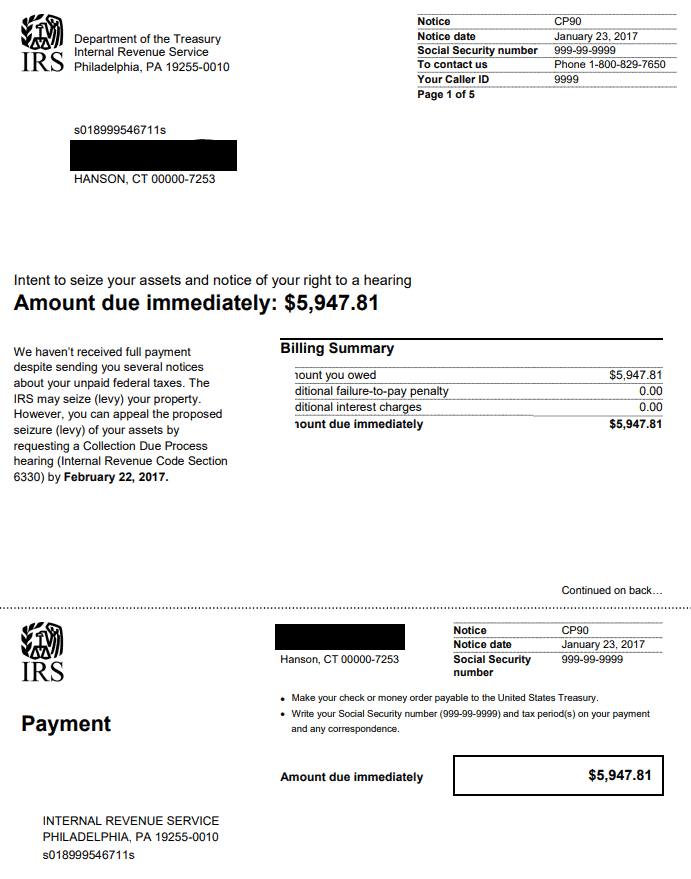

What does irs notice cp504b mean - What is a cp504 Notice. If you have received an IRS CP504 Notice of Intent to Levy and you do not agree with your outstanding tax bill consider consulting one of our tax attorneys to discuss your options for disputing the bill. CP090 Final Notice of Intent to Levy and Notice of Your Right to a Hearing notice IRS Notice CP090 tells individual taxpayers that the IRS intends to levy on the taxpayers assets. If you received a CP508C notice the IRS has identified your tax debt as seriously delinquent and has provided that information to the State Department.

An IRS Notice CP504 or a Notice of Intent to Levy is a serious letter for any taxpayer. If you agree with the information there is no need to contact us. IRS Letter or Notice Number. If when you search for your notice or letter using the Search on this page it doesnt return a result or you believe the notice or letter looks suspicious contact us at 800-829-1040.

If you do not pay the amount due immediately the IRS will seize levy certain property or rights to property and apply it to pay the amount you owe. You have an unpaid amount due on your account. Learn what it means to receive one of these notices and what you should do to resolve it quickly and painlessly. IRS Notice CP504 Intent to Levy State Tax Refund or Other Property.

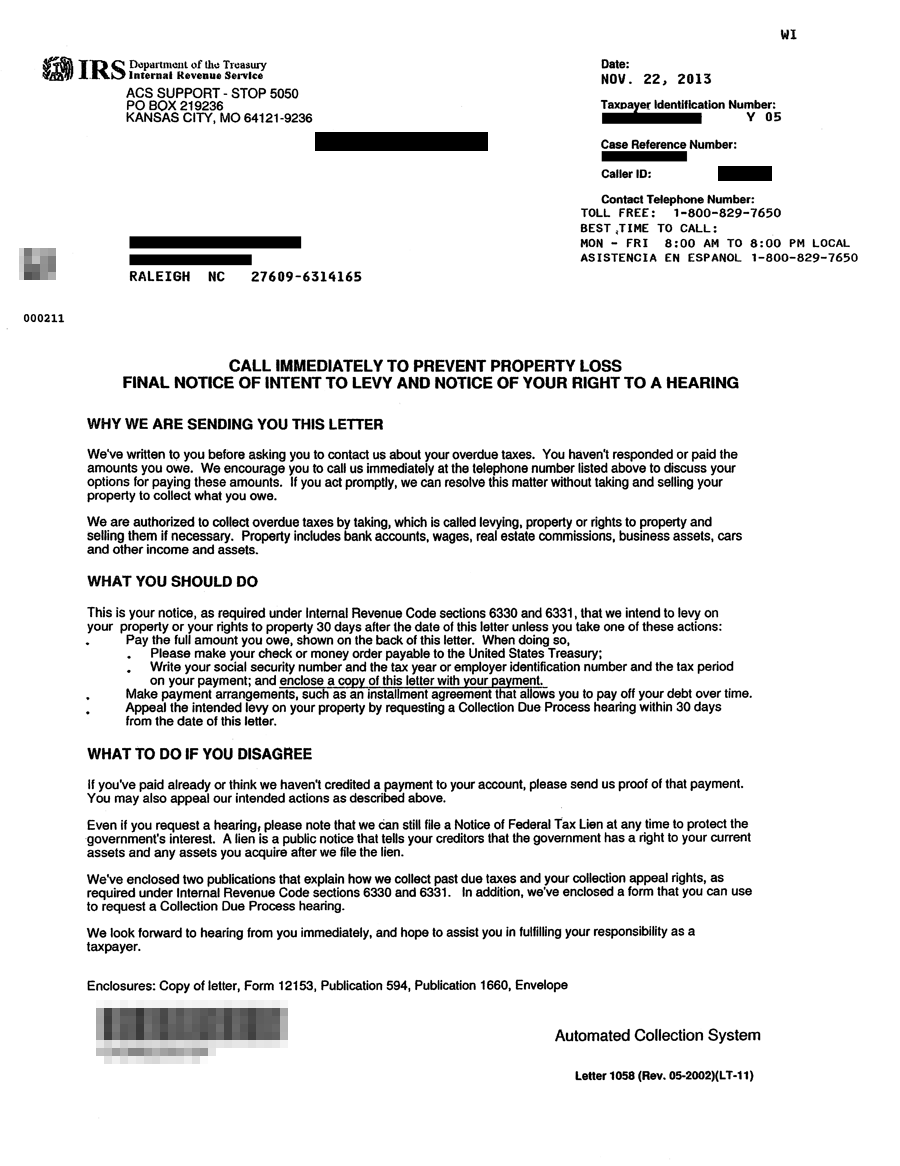

Some of this correspondence appears threatening but actually doesnt have much bite Other correspondence means there could be serious danger up ahead and may require immediate action. Address an IRS bill for. Notice CP504B is similar to Notice CP297 and requires the same sense of urgency. A CP504b relates to your business tax bill and signifies the IRS is intending to seize business assets if you do not pay your outstanding balance.

This notice is a reminder that you owe a balance on one of your tax accounts. This notice means the government will find a way to forcibly take what is owed by. Notice CP515B is similar to Notices. If youre receiving a CP504B or CP504 notice it means you have a past-due bill with the IRS.

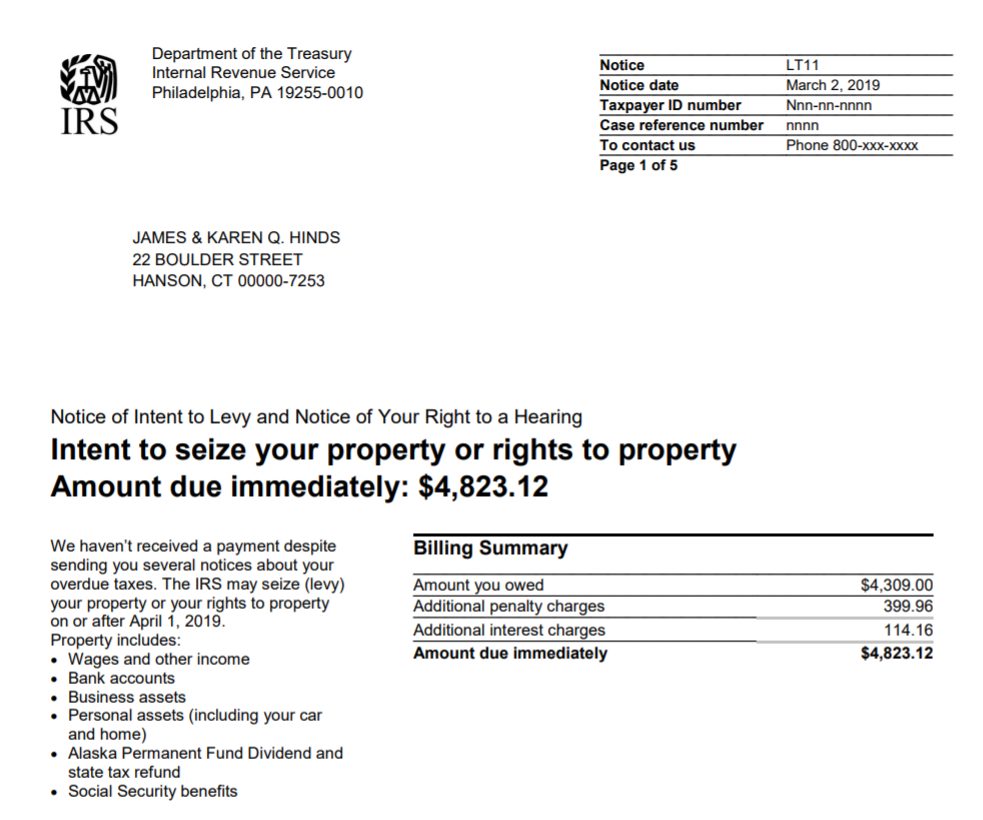

CP504B Final Notice Balance Due notice IRS Notice CP504B is provided to business taxpayers who request a copy of a previously issued CP504. If you dont have a passport the IRS can deny your application if you have a CP504 filed against you. The newest addition to the IRS CP504 notice is a paragraph describing the passport revocation provisions of the Fixing Americas Surface Transportation FAST Act. If you owe a balance to the IRS you will receive this notice.

Generally the IRS sends this notice after sending you a CP14The CP501 is a relatively straightforward notice letting you know that you need to pay your outstanding income tax bill. The Bureau of the Fiscal Service only facilitates the transfers of the refund between IRS and the agency that the balance is owed to it wont have information about your IRS account or where the money is being. The Notice CP504 also referred to as the Final Notice is mailed to you because the IRS has not received payment of your unpaid balance and tells you how much you owe including additional penalties and interest when its due and how to pay before further collection action takes place. This notice is URGENT and informs you that in 30 DAYS short of action on your part they will take aggressive collect action.

It is very similar in effect to the other Notices of Intent to Levy. You should consult an attorney if you receive Notice CP504B. Should the IRS fail to hear from you or your Tax Representative the agency is mandated to proceed with enforced collection action including filing tax liens issuing bank levies garnishing your wages and seizing your valuable assets. Here are the most common types of IRS Letters and Notices and what they mean.

For example the IRS CP504 is the final attempt and notice before a bank levy begins. IRS Notice CP504B is an URGENT notice to inform you the IRS intends to levy against the business assets. Notice CP504B indicates that the IRS intends to levy against your business assets. This is the legislation that calls for revocation or denial of passports where a taxpayer is considered seriously delinquent meaning they owe more than 52k and have not made arrangements with the IRS to pay.

The State Department generally will not renew your passport or issue a new passport to you after receiving this certification from the IRS and they may remove or place limitations on your current passport. It also means the IRS has sent you letters before and you havent been able to take care of the issue because either you cant pay the balance due dispute that its owed or arent sure how to fix it. If the letter is from the Department of the Treasury Bureau of the Fiscal Service these notices are often sent when the IRS takes offsets some or part of your tax refund to cover another non-IRS debt. You can find the IRS Letter or Notice number on the top or bottom right-hand corner.

The IRS verified your claim of. The IRS intends to levy your state tax refund if no response is received. The CP504 talks about Urgent IRS Levy Action. When the IRS sends you a CP504 notice the government entity satisfies a legal requirement to give you notice of its intent to levy as necessitated by Internal Revenue Code section 6331d.

CP504 is an urgent notice informing you that you owe a balance due and that you must respond immediately. Reminder of Balance Due Meanings Actions Needed. Finally a CP504 notice gives the IRS permission to revoke your United States Passport which can make it impossible for you to leave the country by land air or sea. You received this notice because we havent received your payment or.

Source Image @ www.taxfortress.com

Source Image @ watax.com

Source Image @ www.taxpayeradvocate.irs.gov

Source Image @ www.hrblock.com

Source Image @ paladinilaw.com

Source Image @ trp.tax

Source Image @ www.hrblock.com

Source Image @ www.hrblock.com

Source Image @ landmarktaxgroup.com

If you re looking for What Does Irs Notice Cp504b Mean you've arrived at the right place. We ve got 10 images about what does irs notice cp504b mean including pictures, pictures, photos, wallpapers, and much more. In these webpage, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.

If the posting of this site is beneficial to our suport by sharing article posts of this site to social media accounts which you have such as Facebook, Instagram and others or may also bookmark this website page together with the title Irs Cp90 Tax Notice What Does It Mean Landmark Tax Group Employ Ctrl + D for computer devices with Windows operating-system or Command line + D for computer devices with operating system from Apple. If you are using a smartphone, you can even use the drawer menu of this browser you utilize. Be it a Windows, Mac pc, iOs or Android os operating system, you'll still be able to download images utilizing the download button.

0 comments:

Post a Comment