What does notice date mean on irs letter ~ What does code 971 mean on my IRS Account Transcript mean. This should happen within 60 days of your initial notice. Indeed recently has been hunted by consumers around us, perhaps one of you personally. Individuals now are accustomed to using the net in gadgets to see image and video data for inspiration, and according to the title of the post I will talk about about What Does Notice Date Mean On Irs Letter IRS LT11 Notice of Intent to Levy.

Source Image @ landmarktaxgroup.com

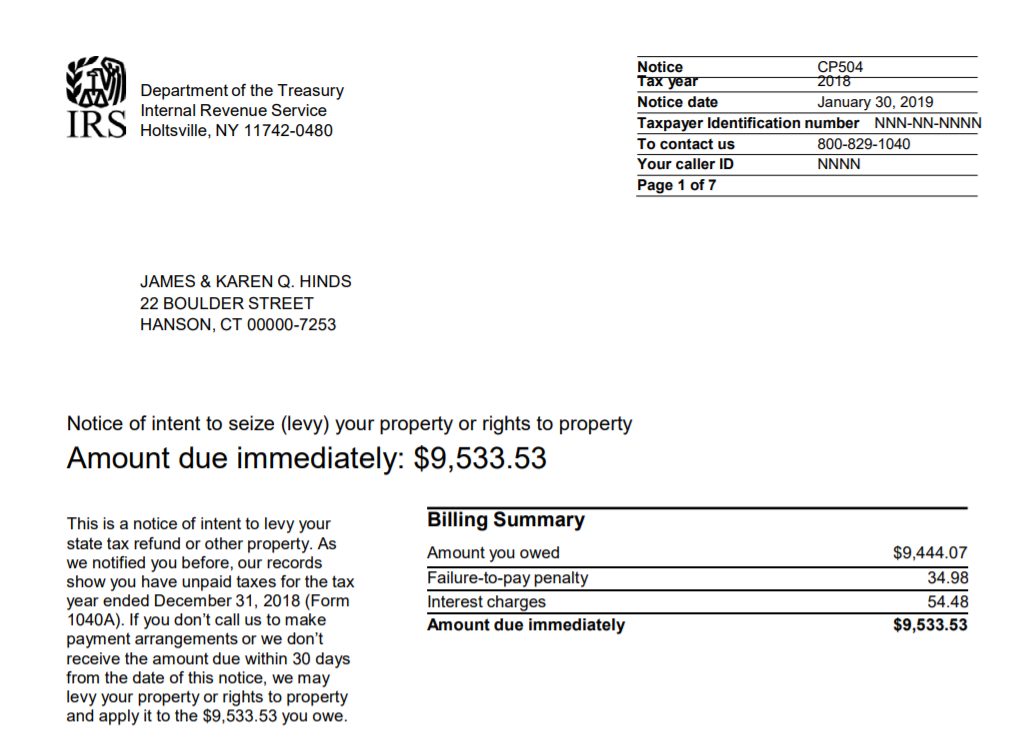

Irs Tax Letters Explained Landmark Tax Group

It has changed now 3 times and is always a future dated date. If you paid a tax preparer or your tax prep software includes audit protection you should notify the appropriate party. Your What does notice date mean on irs letter picture are ready. What does notice date mean on irs letter are a topic that is being hunted for and liked by netizens today. You can Find and Download or bookmark the What does notice date mean on irs letter files here

What does notice date mean on irs letter - The date is always a sending date as they or anyone else cannot control delivery. This IRS letter is one of the most simple and straightforward and typically follows CP-14. What this Means and What to Do. IRS Letter 12C officially labeled LTR0012C is a notice that the IRS needs more information before it can process your return.

The IRS inquiry letter does give a few options as if to jog ones memory. This date didnt appear till 3 weeks or so after acceptance by IRS. A CP 501 notice is one of the most simple and straightforward letters. If theres no notice number or letter its likely that the letter is fraudulent.

The most common reason is a missing form. DO NOT ALLOW the time to expire without contacting them or hiring a representative to contact them for you. Similar to CP297 LT1058 this notification gives the IRS the legal right to seize your assets within 30 days. On mine it was accepted 32020.

The only real difference is that a CP60 refers to a misapplied payment to an account while CP260 refers to a misapplied payment to a tax return. This is sent to notify you of a balance due. These letters provide taxpayers with information about their right to challenge proposed IRS adjustments in the United States Tax Court by filing a petition within 90 days of the date of their notice 150 days if you reside outside the United States. If you were out of town or didnt receive the notice on time immediately call either your tax professional or the IRS directly.

Generally IRS notices have a notice date at the top right hand corner of page 1 of the notice. Response to our inquiry or notice. Taxpayers who receive a notice saying the IRS changed the amount of their 2020 credit should read the notice. Yes each letter or notice from the IRS or State will indicate a date that you MUST to contact them by.

This notice or letter may include additional topics that have not yet been covered here. The IRS Needs More Information. It could be Letter 3228LT39 Reminder Notice letter or it may even be the IRS sending you Notice number CP12 which outlines Changes to Tax Return Overpayment. If youve received Letter 11 that is the IRSs notification that it plans to levy your property.

This date is the date the notice was issued and usually you have 30 or 45 days depending on the notice to respond. Then they should review their 2020 tax return the requirements and the worksheet in the Form 1040 and Form 1040-SR instructions. I have still not heard or gotten any letter. This is what shows on account transcript.

If you have already paid. The letter is to advise you of their intent to seize your property or rights to property. Real IRS letters have either a notice number CP or letter number LTR on either the top or bottom right-hand corner of the letter. If you agree with the information there is no need to contact us.

If you are getting a paper check it will take longer than an electronic deposit because there is a lot more work and people handling the check from the IRS to the post office. Its scary when you receive. It has a date of notice issued 4317 and prior to that I had code 570 on the account transcript. CP 501 Reminder Notice Balance Due.

Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. Erin Forst March 19 2020. Youll then want to follow up with the IRS. Yes it says other This list is taken directly from the IRS letter 2645C.

135 rows Tax returns processed by the IRS in 2018. An IRS Notice CP60 is not to be confused with an IRS Notice CP260 which can be strikingly similar. So what action should you take. When the IRS sends through certified mail it can mean that the notice is in regard to a highly time-sensitive issue.

I believe they are referring to the photo below. When it changes it changes by 7 days each time. If when you search for your notice or letter using the Search on this page it doesnt return a result or you believe the notice or letter looks suspicious contact us at 800-829-1040. If you need more time call the number on the notice or letter and request an extension.

First Notice A first B Notice is defined as a name and TIN combination that hasnt been identified in a B Notice received within the last three calendar years. What You Dont Want to Do. This is the date the clock starts running if you have X days to respond. If you already paid in full or think the IRS hasnt credited a payment send proof of that payment to the IRS at the address on the notice.

The IRS may send letters via regular mail or through certified mail. An IRS notice of deficiency is also often referred to as a 90-day letter Thats because youll have 90 days from the date of the letter to either accept the change or additional tax liability or you can elect to challenge or appeal the notice. You dont need to do anything unless you receive a follow-up letter from the IRS. A CP05 notice is simply a notice that the IRS is auditing you.

Its recommended you call the IRS at 800-829-1040. Here are some common reasons the IRS corrected the credit. IRS Notice CP2100 and CP2100A doesnt distinguish between first and second B Notices so its up to the filer to identify and delineate between them. This is the second notice that the IRS sends to let you know about the money you owe.

It goes on to say that the IRS hasnt resolved the matter because. I may receive a fee if you choose to use linked products and services.

Source Image @ landmarktaxgroup.com

Source Image @ www.hrblock.com

Source Image @ thecollegeinvestor.com

Source Image @ www.taxaudit.com

Source Image @ www.pinterest.com

Source Image @ www.hrblock.com

Source Image @ paladinilaw.com

Source Image @ trp.tax

Source Image @ thecollegeinvestor.com

If you re searching for What Does Notice Date Mean On Irs Letter you've come to the perfect place. We ve got 10 images about what does notice date mean on irs letter adding pictures, photos, photographs, backgrounds, and much more. In such webpage, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

If the posting of this internet site is beneficial to our suport by discussing article posts of the site to social media accounts to have such as for example Facebook, Instagram and others or may also bookmark this blog page while using title What Is A Cp05 Letter From The Irs And What Should I Do Work with Ctrl + D for computer system devices with House windows operating-system or Command + D for laptop devices with operating-system from Apple. If you use a smartphone, you can even use the drawer menu from the browser you utilize. Be it a Windows, Apple pc, iOs or Android os operating system, you'll be in a position to download images using the download button.

0 comments:

Post a Comment