What does notice cp05 mean ~ This is usually the fourth notice that is sent and will inform the taxpayer that a levy will be issued against their state tax refund. When the IRS sends through certified mail it can mean that the notice is in regard to a highly time-sensitive issue. Indeed lately has been hunted by users around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to see image and video data for inspiration, and according to the name of this article I will talk about about What Does Notice Cp05 Mean A CP05 notice is a letter from the IRS telling you that your tax return is being reviewed.

Source Image @ www.jacksonhewitt.com

What Is A Cp05 Irs Notice

IRS Notices CP05 CP05A both indicate that the IRS is holding your refund pending a request for information. Please do not call us until 60 days after the notice date and only if you havent received your refund or heard from us by then. Your What does notice cp05 mean pictures are available. What does notice cp05 mean are a topic that is being hunted for and liked by netizens now. You can Download or bookmark the What does notice cp05 mean files here

What does notice cp05 mean - Your refund is being held pending a review of your return. Read through the notice once to see if you understand it. The IRS may contact third parties to verify information shown on the return. The Notice CP05 merely indicates that the IRS is reviewing your tax return and verifying the following items among other things.

The CP 05 notice advises the taxpayer that the return is being reviewed and the refund held to ensure the accuracy of. If you have an IRS account online Id. This is a final notice of a balance that is due on the taxpayers account. To submit a valid claim you.

A Notice CP05 is one of the letters that do not request that you respond to the IRS. It could be Letter 3228LT39 Reminder Notice letter or it may even be the IRS sending you Notice number CP12 which outlines Changes to Tax Return Overpayment. The IRS CP05 letter is a notification the IRS has placed a hold on the refund until they can verify one or more items reported on the tax return. The most common reason for the IRS to review a tax return is something called the Discriminant Function System or DIF score.

Covered Tax Return means a Federal excluding non-resident state or local tax return for the 2020 tax year that was prepared through the Service and filed on or prior to May 17 2021 or June 15 if you were eligible for and received an automatic extension or if the filing date is properly extended October 15 2021 for which no Exclusion as defined below applies. A CP05 letter is usually the first correspondence letter sent by a specific department in the IRS that reviews mostly the income and withholding on the return and compares it with the W2 1099 etc that employers financial institutions send in. McNamee CPA writes for TaxBuzz a tax news and advice website. Each IRS notice has a title and should contain a summary of the problem identified.

It could be a mistake on the return but not always. CP 504 IRS Intent to Levy. IRS Letter CP05 notifies the taxpayer that his or her tax refund is being held until the IRS finishes reviewing the taxpayers tax return. How to Find Out What IRS Notices and Letters Mean.

The IRS might also use Letter 4464C. If they need further information they will send you a letter asking for more details. It may also include details stating that IRS plans to search for other assets on which a levy can be placed. The CP05 notice means that the IRS is holding your refund until they can review and verify one or more of the following items on your return.

Your return has been selected to be reviewed by the IRS. CP05 are usually sent out when something about your return matches a known or established fraudulent refund pattern. IRS Notice CP05 Your Refund is Being Held While The IRS Reviews Your Tax Return. That doesnt mean yours is wrong but schemes are based on the plausible.

Income reported on the return Income tax withholding amounts reported on the return. What this notice is about We need information before we can send a refund. The IRS uses a computerized scoring model that evaluates your return and gives it a score based on the likelihood that it will need to be changed. It means something on your return triggered an alert that requires further review.

There is usually no need to be concerned and it is often random selection. Our team of expert audit representatives which includes attorneys CPAs and Enrolled Agents provides tax audit help for thousands of cases each month. There is also an identifier in the top corner of the notice that is either CP followed by a number or Letter followed by a number. This notification lets you know the tax refund you expected to receive in a few weeks may take more time to arrive.

What this notice is about Were verifying your income income tax withholding tax credits andor business income. The goal of the letter is to let you know that your refund may be delayed and that the IRS may request more information from you. It infers definitely what it says. What does IRS tax message Your tax return is still being processed.

A CP05 notice doesnt mean that youve done something wrong or that youve made an error. Social Security benefits withholdings. It is also possible that your address has a bad affiliation or something may have happened last year to make the IRS believe your information may have been compromised. If there are severe red flags it might make sense to hire a licensed tax professional to communicate with the IRS on your behalf.

View notice CP05 image. CPO5 is the type of notice it is. Heres an extract from the IRS Internal Revenue Manual. What you need to do Send us copies of the items listed on the notice so we can verify your income and income tax withholding.

Just be prepared for a long wait because youre probably not the only one calling about a missing refund. The IRS may send letters via regular mail or through certified mail. Finally remember that if your delayed refund is a sign that an audit is pending dont. If you filed a return You dont need to take any action.

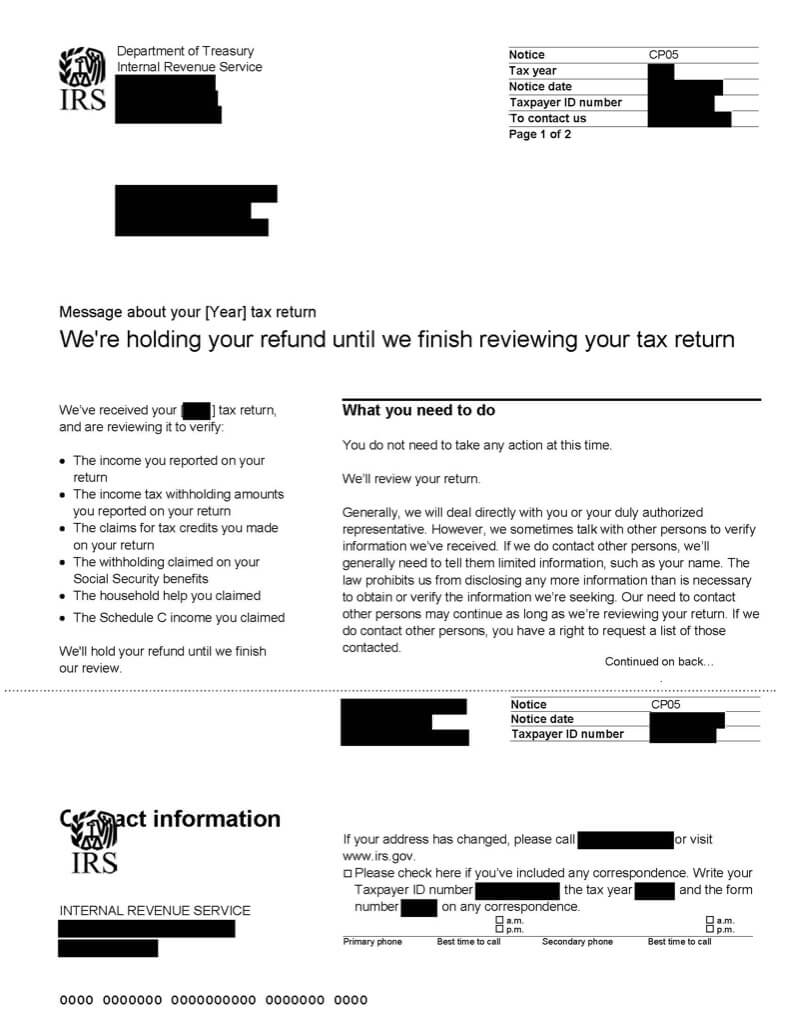

Department of Treasury Internal Revenue Service CP05 Tax year Notice date Taxpayer ID number TTo contact us Page 1 of 2 0000 0000000 0000000000 0000000 0000 If your address has changed please call or visit wwwirsgov. A CP05 notice sometimes leads to a full-blown audit. Its an alert and nothing else. If you received an IRS CP05A Notice the IRS is examining your tax return and needs you to send verifying documents.

Please check here if youve included any correspondence. What does cpo5 means. Schedule C income claims. A refund date will be provided when available indicate.

Theyre setting up your return and when theyre set theyll post the date your rebate will be open or a message about an issue with your return. They review certain items on your return. The IRS explanations of the issues or items requested are often very vague. To determine this score the model compares your return to similar.

IRS Notices CP05 CP05A CP05B all indicate that the IRS is holding your refund. Notice CP05A asks you to supply the IRS with documentation to. With Notice CP05 they dont request anything of you until they have finished their review of your return. You will need to review the line item on your return being questioned and prove that item.

Income tax withholdings reported.

Source Image @ thecollegeinvestor.com

Source Image @ thecollegeinvestor.com

Source Image @ www.taxaudit.com

Source Image @ thecollegeinvestor.com

Source Image @ thecollegeinvestor.com

Source Image @ igotmyrefund.com

Source Image @ www.mxcpkk.co

Source Image @ www.taxaudit.com

Source Image @ www.legacytaxresolutionservices.com

If you are searching for What Does Notice Cp05 Mean you've reached the perfect location. We ve got 10 graphics about what does notice cp05 mean adding pictures, pictures, photos, wallpapers, and more. In these page, we additionally provide variety of graphics available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

If the publishing of this internet site is beneficial to your suport by revealing article posts of this site to social media marketing accounts which you have such as Facebook, Instagram and others or can also bookmark this blog page using the title Irs Notice Cp05 Understanding Irs Notice Cp 05 Return Errors Make use of Ctrl + D for laptop devices with Home windows operating-system or Command line + D for laptop devices with operating-system from Apple. If you use a smartphone, you can also utilize the drawer menu with the browser you use. Whether its a Windows, Apple pc, iOs or Android operating system, you'll still be able to download images utilizing the download button.

0 comments:

Post a Comment